Crypto Taxation India 2026 & Blockchain Compliance

Feb 12, 2026

Crypto Taxation India 2026 has become a defining factor in shaping India’s blockchain ecosystem. As digital assets expand globally, India’s regulatory focus has strengthened around crypto taxation and blockchain compliance, ensuring transparency, accountability, and long-term sustainability.

Moreover, the Union Budget 2026 reinforces structured governance for cryptocurrency transactions and blockchain-based businesses. Therefore, Web3 startups, crypto investors, and enterprises must now align innovation with compliance-driven frameworks.

At ITSpectrum Solutions, we actively monitor developments in crypto taxation policy and blockchain compliance in India, helping enterprises design future-ready blockchain infrastructure.

Let’s explore what the Union Budget 2026 means for crypto taxation and blockchain compliance in India.

1. Union Budget 2026: Strengthening India’s Crypto Tax Framework

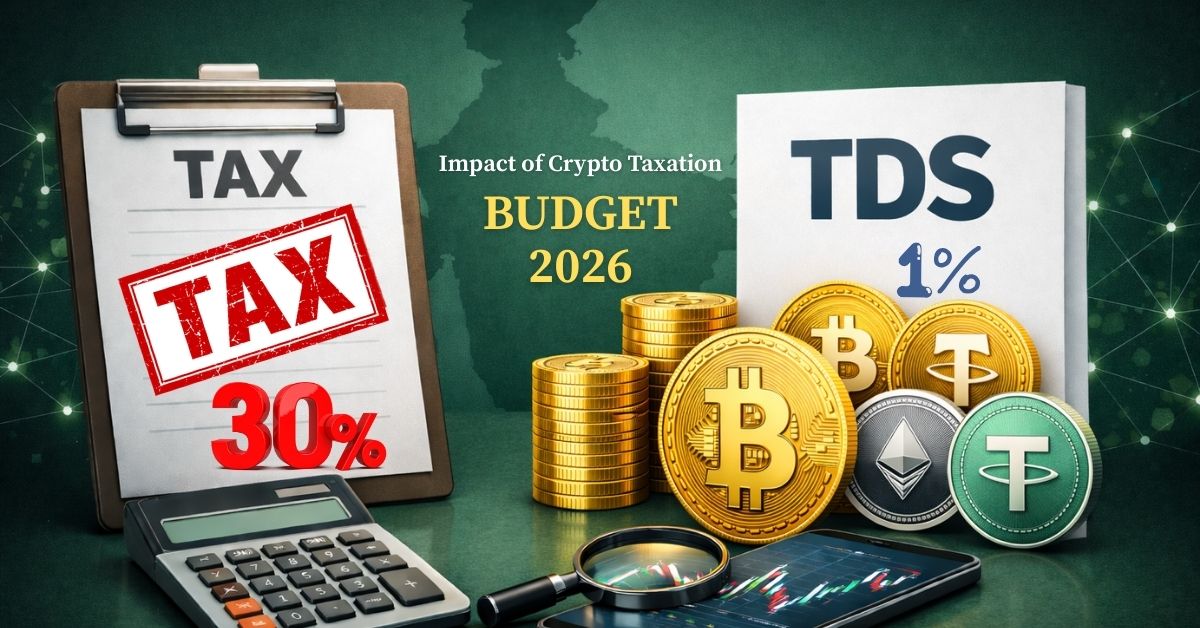

One of the most critical highlights of the Union Budget 2026 is the continued emphasis on crypto taxation in India. Although many expected revisions in TDS or capital gain's structure, the government retained the existing Virtual Digital Asset (VDA) taxation model.

Current Crypto Tax Structure in India (Post-Budget 2026)

- 30% tax on gains from cryptocurrency transactions

- 1% TDS on crypto transfers

- No set-off of losses against other income

- Mandatory reporting and compliance disclosures

As a result, crypto taxation compliance remains central to operating legally in India. Furthermore, this structured tax policy signals regulatory maturity rather than restriction.

Why Crypto Taxation Matters for Blockchain Businesses

Because blockchain platforms manage digital asset transactions, they must now integrate automated tax calculation systems. In addition, exchanges, DeFi platforms, and NFT marketplaces must implement real-time reporting features.

Consequently, blockchain development and crypto taxation compliance must work together at the architectural level.

At ITSpectrum Solutions, we help clients design blockchain systems that incorporate structured accounting logic and compliance-ready frameworks from day one—ensuring scalability without regulatory friction.

2. Blockchain Compliance in India: A New Era of Accountability

Beyond taxation, the Union Budget 2026 emphasizes the importance of blockchain compliance in India. The message is clear: innovation must coexist with accountability. Blockchain compliance includes adherence to:

- Know Your Customer (KYC) regulations

- Anti-Money Laundering (AML) guidelines

- Financial reporting standards

- Transaction monitoring requirements

- Cross-border data transparency norms

As India aligns with global financial monitoring systems, digital asset platforms must maintain detailed audit trails and identity verification mechanisms.

Why Compliance Matters More Than Ever

In earlier years, many blockchain startups prioritized decentralization and speed over governance. The 2026 regulatory environment reverses that priority.

Today, investors, enterprises, and regulators expect:

- Secure smart contract architecture

- Transparent tokenomics

- Multi-layer security in crypto wallets

- Data integrity within decentralized applications (DApps)

- Real-time monitoring of suspicious activities

ITSpectrum Solutions integrates compliance modules within blockchain development, whether building white-label crypto exchanges, DeFi platforms, NFT marketplaces, or enterprise DApps—ensuring businesses operate confidently within India’s legal ecosystem.

3. Impact on Blockchain Startups and Web3 Entrepreneurs

The impact of Union Budget 2026 extends beyond taxation—it reshapes business strategy. The message is clear: innovation is welcome, but it must be structured, transparent, and accountable.

Increased Operational Responsibility

Blockchain startups can no longer focus solely on product development and token launches. They must now build operational systems that align with regulatory expectations from day one.

Here’s what that shift looks like in practice:

| Area | What It Means for Startups |

|---|---|

| Legal Structuring | Proper regulatory classification and documentation |

| Compliance Software | Automated tax and transaction monitoring |

| Smart Contract Audits | Security validation before deployment |

| Reporting Automation | Accurate gain/loss and tax summaries |

| Data Security | Strong encryption and breach prevention |

Shift Toward Long-Term Sustainability

The era of speculative growth is gradually giving way to structured expansion. While stricter regulations may initially slow rapid experimentation, they create a foundation for institutional participation and global partnerships.

Startups that embrace compliance-driven blockchain development will likely:

- Attract venture capital more easily

- Gain trust from institutional investors

- Achieve smoother global market expansion

- Avoid regulatory disruptions

At ITSpectrum Solutions, we guide Web3 founders through technology architecture planning, smart contract security, token structuring, and scalable backend integration to ensure their platforms are resilient in a regulated environment.

4. Enterprise Adoption of Blockchain Post-Budget 2026

While cryptocurrency trading faces strict taxation, blockchain technology itself continues to gain acceptance across industries.

The Union Budget indirectly supports enterprise blockchain adoption by reinforcing transparency and legitimacy in the digital asset space.

Growing Enterprise Use Cases in India

- Supply chain transparency

- Digital identity management

- Document verification systems

- Tokenized asset management

- Decentralized finance (DeFi) platforms

- NFT-based engagement ecosystems

As compliance clarity improves, traditional enterprises feel more confident in integrating blockchain solutions into their digital transformation strategies.

ITSpectrum Solutions works with enterprises across sectors to deliver:

- Secure smart contract development using Solidity tailored to business and compliance needs

- Customizable Forex CRM solutions to streamline brokerage and client management operations

- Scalable and secure DApp development with robust backend architecture

- Multi-currency wallet development with advanced encryption and security features

- Crypto payment gateway solutions for seamless B2B and B2C transactions

- Affiliate marketing software with integrated tracking, commission management, and analytics systems

Our agile development process ensures that blockchain infrastructure remains adaptable as regulations evolve.

5. Regulatory Evolution: From Uncertainty to Structured Innovation

India’s regulatory journey in the crypto and blockchain sector has evolved significantly over the past few years. Union Budget 2026 represents a transition from uncertainty to structured governance.

Benefits of Regulatory Clarity

- Stronger safeguards for investors through clearer regulatory oversight and structured compliance measures

- Lower risk of fraud and unlawful transactions due to improved monitoring and transparency standards

- Increased confidence among institutional investors is driven by policy clarity and accountability

- More defined and streamlined tax reporting processes for digital asset transactions

- Better integration with global financial systems through standardized regulatory alignment

While taxation remains stringent, clarity reduces policy ambiguity—a factor that often deters large-scale adoption.

For technology providers like ITSpectrum Solutions, this shift reinforces the importance of building blockchain platforms that are secure, scalable, and future-proof.

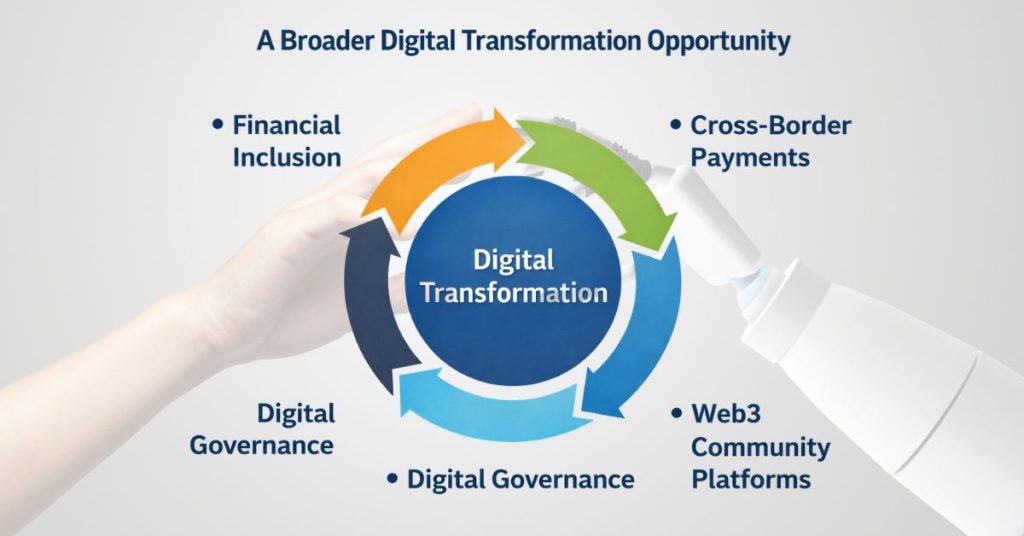

6. The Broader Digital Transformation Opportunity

Blockchain compliance is not just about avoiding penalties—it is about building digital trust. India’s digital economy is expanding rapidly, and decentralized technologies are expected to play a key role in:

- Financial inclusion: Expanding secure financial access to underserved populations.

- Cross-border payments: Enabling faster and more cost-effective global transactions.

- Digital governance: Improving transparency and efficiency in public systems.

- Web3 community platforms: Supporting decentralized, user-owned digital ecosystems.

- Metaverse applications: Powering virtual environments with blockchain-based ownership and economies.

As regulatory frameworks mature, blockchain innovation will increasingly move beyond crypto trading into enterprise infrastructure and public-sector use cases.

ITSpectrum Solutions positions itself as a long-term technology partner in this transformation—combining blockchain development expertise with custom web and mobile application solutions, enterprise software development, strategic consulting, and ongoing maintenance support.

7. Future Outlook: Crypto Taxation and Blockchain in 2026 and Beyond

To better understand the shift in India’s crypto and blockchain landscape, here’s a comparison of the ecosystem before and after Budget 2026:

| Aspect | Earlier Phase | Post-Budget 2026 Environment |

| Regulatory Clarity | Policy uncertainty and evolving guidelines | Clearer, structured taxation and compliance framework |

| Investor Confidence | Cautious participation due to ambiguity | Growing confidence driven by defined rules |

| Compliance Standards | Flexible and inconsistently implemented | Stricter, standardized compliance expectations |

| Institutional Adoption | Limited involvement from large institutions | Increasing interest from enterprises and institutional investors |

| Market Stability | Volatile and sentiment-driven | More structured and governance-oriented |

This table visually highlights how India’s blockchain ecosystem is transitioning from uncertainty to structured growth under a clearer regulatory framework. While some market participants hoped for tax relaxation, the current framework provides stability—a key ingredient for institutional maturity.

The blockchain ecosystem in India is entering a new phase where:

Innovation must be secure. Decentralization must be accountable. Growth must be compliant.

Conclusion

The Union Budget 2026 has reinforced India’s commitment to a regulated and transparent cryptocurrency ecosystem while encouraging responsible blockchain innovation.

Ready to Build a Compliance-Ready Blockchain Platform in 2026?

The Union Budget 2026 confirms that Crypto Taxation India 2026 and blockchain compliance are central to India’s digital economy strategy.

Although the tax structure remains strict, it provides long-term stability. Moreover, businesses that integrate crypto taxation logic and blockchain compliance systems today will lead to tomorrow’s Web3 transformation.

At ITSpectrum Solutions, we specialize in compliance-ready blockchain development, ensuring your platform aligns with India’s evolving crypto tax regulations.

Let’s build your next blockchain solution with compliance at its core.

Contact us at [email protected] or visit our website at www.itspectrumsolutions.com.

Call Us: +91 9073331837 / +91 8100009773

Email: [email protected]

For more info: www.itspectrumsolutions.com